We asked you to rate the Mac personal finance software that’s near and dear to your heart (or that had let you down), and nearly 700 TidBITS readers answered our survey of 34 apps with close to 1,400 votes (see “Vote for Your Favorite Mac Personal Finance App,” 17 February 2016). We found that the landscape for finance apps is still dominated by Intuit’s Quicken, but there are several alternatives that our readers recommend wholeheartedly.

Nov 20, 2019 Banktivity 7 (formerly iBank) is a top pick for personal finance software for Mac. Update 01/2016: YNAB has switched to a cloud-based version, with lots of new features and slightly different rules. Most of the recommendations below still apply though! If you're looking for something easy and fun to get started, and a software that doesn't overload you with functionality.

All four versions of Quicken in our survey made the top ten in terms of vote count, with varying ratings. While few apps elicit the level of contempt and resignation as the most recent Quicken editions, Quicken 2007 finished near the top for both vote count and ratings. To paraphrase the band Chicago, Quicken can be a hard habit to break. Quicken 2007 user Paul Brown voiced his reluctance in testing other finance apps. “You can’t do a good evaluation of any financial management application without really using it for some significant time period,” he said, “and meanwhile you want to keep your data entry current in your current application, doubling the time and effort spent doing your bookkeeping while also doing new appevaluation.” Despite the extra work, he continues to explore alternatives (particularly SEE Finance), as he’s worried about Quicken’s long-term viability due to Intuit’s plan to sell it (see “Intuit to Sell off Quicken,” 24 August 2015).

Best Finance App For Mac

Still, some have found alternatives to the Quicken quagmire. Here are a few takeaways:

- When looking at the top Quicken alternatives by weighted average and vote count, Moneydance (the top rating, second-most votes) and Banktivity (most votes, third-best rating) are the clear favorites.

- If those two don’t float your boat, check out other apps that scored well in the ratings, but didn’t collect quite as many votes (such as SEE Finance, Moneywiz, and CheckBook/CheckBook Pro).

Be sure to look at the full results and read the comments on the original article, since there’s a lot of useful information there that we couldn’t convey here.

Don’t forget to read Michael Cohen’s articles on “Finding a Replacement for Quicken” (5 August 2011) and “Follow-up to Finding a Replacement for Quicken” (20 September 2011), which helped readers understand their needs and choose from the available alternatives.

When it came time to evaluate the results, we calculated the weighted average for each app, assigning a weight of 1 (Avoid it) through 5 (Can’t live without it) for each the five choices — the best weighted average possible is thus 5. Apps that received only a handful of votes have skewed weighted averages, of course, so we also counted the raw number of votes each app received.

Here’s the full list of financial apps, sorted by number of votes. We offer rating graphs and commentary for the apps that garnered the most votes; for the rest, the research is up to you, since only you know what features are important. Focus on apps that have free trial versions and strong import capabilities, since you’ll want to get some experience with the app before you commit to it, and because you’re likely to want to use this app for years, stick with apps that are getting regular updates.

Quicken 2007 (244 votes, 3.16, 10.7+) — Read comments from the previous article.

The cumulative 800-pound gorilla of Mac finance apps, four editions of Quicken made it into the top ten — Quicken Essentials, Quicken for Windows, Quicken 2015/2016, and Quicken 2007 — with a total of 602 votes. In terms of rating and votes, Quicken 2007 topped the Intuit list, and many commenters pointed to the comfort they felt in continuing to use a now-discontinued app first released over eight years ago. Doug Hogg said, “It’s like an old shoe — I know how to work it, so I am not changing until I have a very good reason.” Andrew Malis noted that Quicken 2007 is “creaky around the edges — I periodically have to rebuild the database — but it continues to work solidly even with a 30 MB database and transactions goingback to 1992.”

John F. Richter added that Quicken 2007 “does everything I need it to do very well. I have been using it from early versions to balance my check books, credit card accounts and maintain my assets and have 15 years of history accumulated. What I like about it is the flexibility of reporting to facilitate tax accounting, reconciliation of accounts, and asset management.” He did try Quicken 2015, but “was reluctant to commit to this weaker version.”

This echoes the main theme that readers cited in not moving to newer editions of Quicken or alternative finance apps — the features work well in Quicken 2007 and haven’t been replicated elsewhere to satisfactory levels. Kelvin Smith said, “I find that the recent versions of Quicken are not useful primarily because they lack annual budgeting.” Edward Pittman has tried other options, but has returned to Quicken 2007 due to cumbersome data entry and less-flexible charts and reports. Dave Creek added, “Quicken 2007 still has by far the best report feature, including custom reports.”

Quicken 2015/2016 (173 votes, 2.54, $74.99, 10.10+) — Read comments from the previous article.

Quicken 2015/2016 was supposed to assume the Quicken mantle, but many point to the lack of Quicken 2007 features — from basic to advanced — missing from the new version (for instance, Glenn Fleishman noted its lack of report customization in “Quicken 2015: Close, But Not Yet Acceptable,” 2 October 2014). Commenter Michael Schmitt pointed to Quicken 2007 being “the gold standard on OS X for tracking and reporting lot-based investments. If you do not track investments, Quicken 2015/2016 may be perfectly adequate for you. But if you do need to track investments, Quicken 2015/2016 still can’t do it.”

It’s notable that this comment from GraniteDon was the highest praise anyone could muster for the latest editions of Quicken: “While Quicken 2016 still lacks some features compared to Quicken 2007 (notably loan amortization), I am satisfied with it and would not consider any other software as long as Quicken is available.”

Unlike Quicken 2007, Quicken 2015/2016 does have a mobile app companion in the free Quicken 2014/2015/2016 Money Management iOS app, but Dennis B. Swaney calls it “rudimentary” (and it has garnered only a 1.5-star rating from the App Store for its most current version).

Both Quicken for Windows (when used in a virtual machine) and the discontinued (and much reviled) Quicken Essentials also placed in the top ten for votes, with Quicken for Windows receiving the ninth-best rating (3.04) from 55 votes. It’s probably an option mostly for people already comfortable with Windows. Despite receiving the fifth-most votes (130), Quicken Essentials has the worst rating of the top ten with a dismal 1.62 — it clearly won’t be missed.

Banktivity (previously iBank) (246 votes, 3.52, $59.99, 10.9+) — Read comments from the previous article.

After going by the name “iBank” for 13 years, our survey’s top vote-getter and third-highest rated app recently underwent a name change to Banktivity (see “Banktivity 5.6.5 (formerly iBank),” 8 February 2016), which IGG Software says is derived “from joining ‘bank’ and ‘activity.’” The company says that it’s easy to import accounts, transactions, categories, and investments from Quicken, and several commenters supported this claim. Martin Zibulsky started using iBank four years ago, and found that importing and converting data from Quicken 2007 was indeed easy. Eckart Goetteappreciated its tracking of international investments and activities, adding, “The multi currency feature is very helpful. I don’t miss Quicken and applaud Banktivity for their innovative features.” Still, the app is not without its frustrations, as commenter Ray said that date handling and scheduled transactions are not as easy to deal with as in Quicken.

Banktivity enables you to use OFX direct connect banking (support varies by bank), and it also includes an integrated Web browser for downloading files from a bank’s Web site. If neither of these options work with your bank, IGG Software also offers the optional Direct Access service (which can be accessed via the Mac app and its two iOS apps), which connects to thousands of banks worldwide and costs $39.99 per year. Unlike Intuit’s free Quicken 2014/2015/2016 Money Management universal iOS app, the Banktivity for iPad app costs $19.99 and Banktivity for iPhone is $9.99 (with the latter providing an Apple Watch app).

Moneydance (154 votes, 3.68, $49.99, 10.7+) — Read comments from the previous article.

Receiving the highest rating of all the apps, Moneydance from The Infinite Kind has been an appreciated Quicken alternative for over a decade (see “Moneydance Eases a Tax Burden,” 11 April 2005). Several commenters gave props to Moneydance doing well with the basics — online banking and bill payment, account management, budgeting and investment tracking, and support for multiple currencies — and voters gave it the top rating. Rick summarized, “It does what I need, upgrades have either been free or reasonably priced, and support (rarely needed) has been very good.” Commenter Reebee added, “Moneydance has its quirks — the interface needs customization options, reports are toolimited, and it needs a proper find and replace option. But the learning curve to switch was easy, I had no trouble importing years of Quicken data, documentation is good, and customer support has been surprisingly helpful.”

While Michel Hedley was a bit frustrated in The Infinite Kind’s speed in making feature enhancements and improvements, Moneydance supports third-party extensions, and a number of free extensions are available to download directly from the company’s Web site (including a Find and Replace extension that could ease Reebee’s complaint). In addition to the Mac, Moneydance is available for Windows and Linux systems, and the free Moneydance Personal Finance Manager iOS app uses Dropbox to sync to Moneydance on your desktop.

SEE Finance (69 votes, 3.61, $49.99, 10.6+) — Read comments from the previous article.

The feature-rich SEE Finance from Scimonoce Software scored the second-best rating of the bunch, and it garnered accolades from commenters for its depth. Steven Mattson gushed, “As an owner of rental property I appreciate [its] transaction downloading capability, fast search engine, ability to create custom reports and tax code indexing. The customer support is the best I have had with any software.” Mac Bakewell chimed in, “I’ve been using SEE Finance since 1/1/11 to manage 20 separate checking, savings, investment, and credit card accounts in two currencies (U.S. dollars and Thai baht). While there is really nothing in my digital world that falls into the ‘can’t live without it’ category, SEE Finance continues to be aperfect fit for my needs, just as it has since day one.”

SEE Finance imports a number of data formats (QIF, QMTF, CSV, QFX, and OFX files), offers investment and loan tracking, provides custom report creation, and works with over 150 currencies. However, Scimonoce Software only offers a desktop app — no iOS app for mobile tracking.

MoneyWell (60 votes, 3.25, $49.99, 10.7.5+) — Read comments from the previous article.

MoneyWell from No Thirst Software garnered the sixth-best rating, with most of its votes giving it a vote of confidence as a solid performer. In addition to the standard ledger system found in other finance apps, MoneyWell uses an envelope-style budgeting system where you’ll assign balances in your accounts to certain buckets. Your expenses will drain those budgetary buckets, and they’ll get refilled each time you add a paycheck or other income. Joseph said, “I love the fact that it uses the envelope system. This is why I bought it in the first place. I don’t just want to track where I spend my money. I want to discipline it.”

Following a stall in development in 2014, No Thirst Software’s ownership was taken over by Kevin LaCoste after original developer Kevin Hoctor was hired by Apple, and updates have appeared more frequently over the last year. Charles E. Flynn has seen improvements, noting, “The program can now duplicate a split transaction, preserving all of the details. If only the QIF format could export split transactions properly, with all of the memo lines preserved, people would be able to move from one program to another easily.” MoneyWell offers two iOS apps — MoneyWell Express for theiPhone and MoneyWell for iPad — and Joseph hopes that their revived development will smooth out what “has always been a squirrelly process.” However, Charlie Franklin switched to Banktivity because of problems importing QFX files and connecting directly to banks in Australia.

The Rest of the Personal Finance Apps — We can’t cover all of the 34 apps that we identified in detail, so for the remaining 26 apps, we’ve listed the number of votes, rating, and price, and included a link to the app’s Web site, along with a link to any available comments about it. Let us know in the comments if there’s a better way we could do it in the future.

GnuCash (34 votes, 2.65, Free, 10.5+) — Read comments from the previous article.

Money (29 votes, 2.41, $39.99, 10.7+) — Read comments from the previous article.

Moneywiz (24 votes, 3.29, $19.99, 10.8+) — Read comments from the previous article.

iFinance (19 votes, 2.89, $29.99, 10.10+)

CheckBook/CheckBook Pro (18 votes, 3.44, $14.95, 10.7+) — Read comments from the previous article.

PocketMoney (17 votes, 3.12, $19.95, 10.6+) — Read comments from the previous article.

iCompta (13 votes, 2.85, $29.99, 10.8+) — Read comments from the previous article.

AceMoney (8 votes, 1.75, $39.99, 10.6+)

Budget (8 votes, 2.38, $39.95, v10.3.9+) — Read comments from the previous article.

iCash (8 votes, 2.00, $49.90, 10.7+)

SplashMoney (8 votes, 1.63, $19.95, 10.8+)

jGnash (7 votes, 2.14, Free, 10.7+)

Liquid Ledger (7 votes, 1.71, $49.99, 10.4+)

Buddi (6 votes, 2.00, Free, 10.5+) — Read comments from the previous article.

moneyGuru (6 votes, 2.33, Free, 10.7+) — Read comments from the previous article.

My Checkbook (6 votes, 2.00, $19.95, 10.4+)

General Ledger (5 votes, 1.20, $14.99, 10.9+)

Finance (4 votes, 1.00, $14.99, 10.5+)

MoneyBag (4 votes, 1.25, $29.99, 10.7+)

My Money (4 votes, 1.50, $49.95, 10.7+) — Read comments from the previous article.

SimpliBudget (4 votes, 1.00, $2.99, 10.7+)

Squirrel (4 votes, 1.25, $14.99, 10.11+)

Growly Checkbook (3 votes, 1.00, Free, 10.7+)

Home Accountz (3 votes, 1.00, £39.00, 10.8+)

Moneyspire (3 votes, 1.00, $54.99, 10.7+)

Savings (3 votes, 1.00, $14.99, 10.10+)

Budgeting is a discipline that’s not often met with excitement. Many assume that budgeting is something reserved for companies or, say, freelance workers. However, personal budget software is just as important as corporate one — it’s a fundamental understanding of where money is coming and going.

You may consider it to be boring, tiring, time-consuming, or difficult, but managing your finances well can help you achieve goals and stave off the stress of a rainy day. Thankfully, there are tools and apps on Mac which can help you get on top of budgeting, no matter how experienced you are.

Why Should I Use Budget Tracking Software?

If you haven’t done a budget before, you should start now. You never know when you might need a particular sum of money to solve an issue, meet a goal, or take advantage of a sudden opportunity.

Budget programs help you reduce the stress and uncertainty that comes with not knowing where you stand financially. If you don’t have a home budget software, you might be tracking towards a situation where you run out of money, without even knowing it. If you do have a budget, then you’ll have a documented plan of action to improve your situation.

Importantly, you don’t need any qualifications to do a budget, nor do you need to be good with numbers. Take advantage of the best budget software for Mac to help you take control of your finances without the hassle. Budgeting tools come in many shapes and sizes, so selecting the right one for you depends on personal preference and previous experience with managing money.

Handy tips for budgeting tools

If you’re ready to start your budget, it’s best to consider a strategic approach to ensure maximum utility. Too often, budgets sit collecting dust after being created, and sometimes the act of creating a budget could feel like enough to satisfy financial concerns — it’s not. Here are some tips for making the most out of your budget.

First of all, definitely use an app to help you manage a budget. App developers invest a lot of time and money into figuring out how their software can make your life easier and better, so rather than trying to understand all the nuances for yourself, let a dedicated app do it for you. There’s even some free budget software around, so you have very few excuses not to try!

If you run a business (or freelance on a side), a little bit of work each week means end of year taxes are a breeze. It’s not about doing a marathon of work in a few days, but making a habit to consistently do a little bit here and there. Try aiming for 10 minutes every few days. The best tax preparation software will also have reminders and notifications to help you achieve this goal.

It might sound contradictory, but budgeting isn’t always about getting the numbers 100% accurate. When it comes to tax preparation software — sure. But budgeting is mostly about understanding where your money is being spent and then using that information to make more informed decisions going forward. Therefore, make sure you categorize your transactions so that it’s easier to spot those minutiae differences and trends. The best finance apps should do this for you automatically.

In summary, you want to ensure you take advantage of the online budgeting tools available to you, aim to update your records frequently, and focus on categorization over accuracy.

Features of good personal budget software

The best personal budget software for Mac is easier to pin down when you know exactly what you’re looking for. Not all apps are the same — they vary by function and pricing. Generally speaking, there are a few key features you want to see in your budget software for Mac:

Best Finance App For Mac 2016 Free

It should be simple and easy to add new records or transactions

Importing bank and credit card statements should be possible

Automatically synchronizing statements will take the edge off your manual inputting

Useful dashboards or visuals will help you understand your situation at a glance

You should be able to categorize your transactions into groups

Out of those five key points, the ability to import is often the most essential. Importing saves you the hassle of adding each transaction into the money management software line-by-line, which adds up to a lot of time. It’s hard enough already to schedule frequent updates to your budget, so if you can remove the largest friction point of manual entry, then you’re in a good place.

The best budget software for Mac comparison

When it comes to programs to help budget money, there are countless options. It’s easy to get lost diving deep into each budget software review, but here are some of the best available, ranging from beautifully basic to powerfully advanced.

You’ve probably heard of Quicken, given that the name has been around since the early 80s. Even then, it was known as one of the best tax software companies around. That says something about the strong product, which carries all of the basic functions you’ll need to manage your budget well.

Right away though, you might notice that the interface has become somewhat dated in comparison to the newer contenders out there. But one of Quicken’s praised features is the ability to download bank statements and have the records automatically categorized, which can drastically reduce the time it takes to input your information, so you can spend more time making sense of it. Sadly, the Mac version is somewhat limited when it comes to advanced features, unless you splash out for the Home and Business edition.

MoneyDance is very similar to Quicken in terms of its basic features, including the ability to create a budget with notifications for bills and invoices. It also allows you to make your own charts and graphs to monitor spending habits over time, which can be seen on the homepage for a quick glance of your activity. Out-of-the-box integrations with online banking services also make it easy to send payments.

Unlike Quicken, Moneydance has some more advanced features including an investment monitor, which tracks your investments and their fluctuations — a useful addition, although best for the intermediate to advanced user. The app also has a developer API system in place to allow extended functions, mostly good for power users. Importantly, security is not an issue, as Moneydance utilizes end-to-end encryption for your data to give you that extra peace of mind.

You Need A Budget, also known as YNAB, is budget tracking software that runs on both Windows and Mac via web — saving automatically to the cloud, which is a bonus for multi-platform users. It also features native apps for iOS and Android, so you can literally tackle your budget from anywhere.

Best Finance App For Mac 2016 Reviews

The app itself follows a simple design language, which is perfect for beginners, but if you find yourself needing help you can sign up for a personal instructor. YNAB doesn’t let you slack at all, and if you start to stray from your budget, the app will raise a red flag through it’s built-in Accountability Partner.

Although YNAB doesn’t support the ability to download and automatically categorize records from bank statements, it could be argued that entering them manually helps the user pay more attention to where their spending is going. Still, it’s a more time-consuming process that might be problematic for users processing hundreds or more records each month.

MoneyWiz stays true to its name — a comprehensive budget software and investment tracker that’s packed full with over 400 useful features. View your financial situation quickly by browsing accounts, groups, or searching for individual records. Speaking of records, you can enter them manually or have them automatically sync with leading banks, cryptocurrency exchanges, and financial services for an accurate real-time understanding of your accounts.

With all of this data in hand, MoneyWiz can prepare and export over 50 reports to help you gain deeper insights into your finances. Your data could be accessed from its cloud-based app or straight from the native software for Mac. All in all, MoneyWiz is extremely powerful: accessible for beginners and interesting for the most advanced users.

Free App For Mac

Receipts is yet another money management software for Mac, and is specifically well-known for its clever handling of invoicing. Using Optical Character Recognition (OCR) technology, Receipts automatically reads and translates important information about your bills, such as amount, date, currency, and more (even if the text is in another language).

Besides, Receipts can issue payments for invoices directly using third-party providers, such as iFinance and BankX. The OCR technology alone makes it a strong contender against other more simple online budgeting tools. Not least, Mac users will be glad to see how this application was designed to look and feel like a macOS product. Using a familiar user interface could make life a little easier after all.

Between the five options above, you have a strong starting point for your budgeting tools depending on your experience. Remember that importing is one of the key features to look for in budget programs. Still, in order to find the best fit you might need to try a couple of different options.

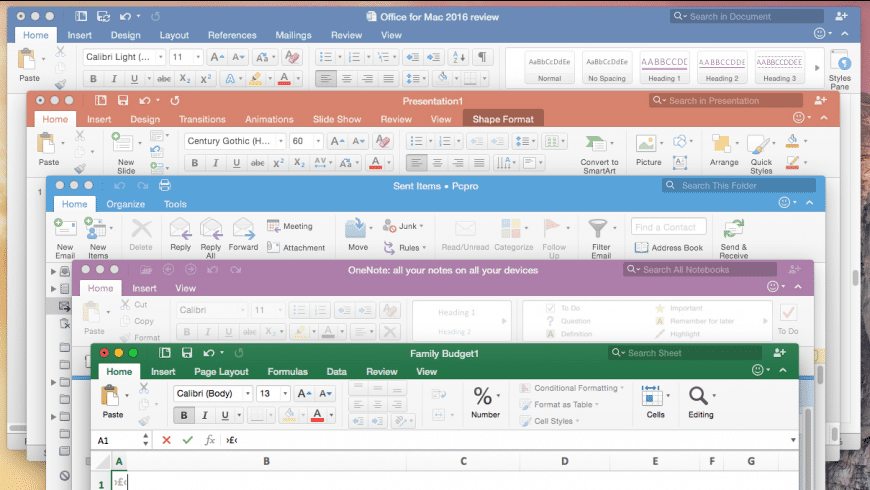

Office 2016 For Mac

Thankfully, both MoneyWiz and Receipts have a free 7-day trial that you can take advantage of by heading over to Setapp, an app subscription service for Mac that gives you access to over 150 macOS apps, including all the necessary budget tools. Getting MoneyWiz and Receipts at once? You won’t be disappointed.